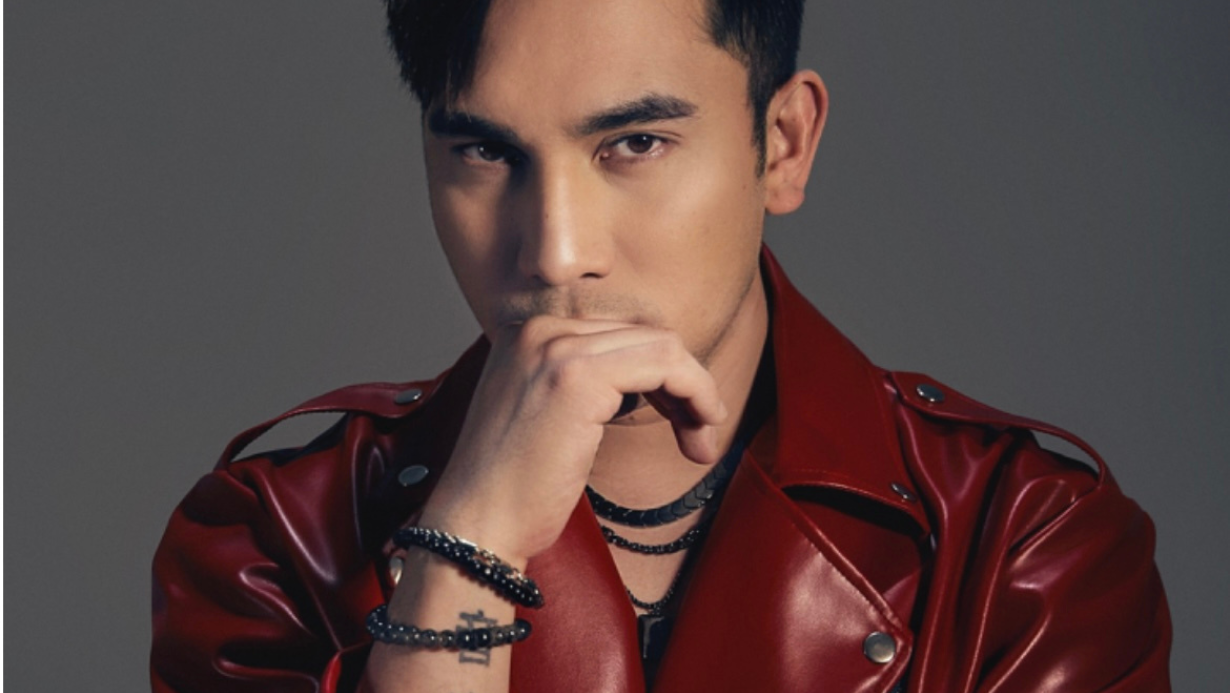

Anthony Pellegrino, of Goldstone Financial Group, has dedicated his practice not only to helping individuals plan for their financial future but also remaining by their side as a partner in achieving their desired results. He provides financial plans targeted at achieving consistent, reliable returns regardless of market fluctuations and uncertainties. He does this by putting his clients’ needs first. As a fiduciary, Anthony Pellegrino has a legal responsibility to put his clients’ needs ahead of his own and is held to a higher ethical standard than non-fiduciary advisors.

Anthony Pellegrino and Goldstone Financial Group have helped more than 1,500 clients bridge the paycheck gap during retirement by utilizing accounts with lifetime income features to guarantee earnings and create a paycheck for life. Pellegrino also offers professional asset management through a diverse portfolio of actively managed accounts and securities.

Anthony Pellegrino is seen Sunday mornings on CBS as the co-host of the television show, “Securing Your Financial Future*.” The show previously aired for five years on WLS 890AM radio station, where it was ranked one of the most listened to* financial and economic radio talk shows in Chicago.

Anthony Pellegrino has ranked in the Top 1% of Safe Money Specialists in the nation and was awarded as one of the Top 10 Advisors in America in 2013.** He was also named a Five Star Wealth Manager in Chicago Magazine twice, as voted by his clients and peers. This is a consumer-based award in the financial services industry given to wealth managers in the Chicago area who scored highest in overall client satisfaction. Pellegrino’s growing success led him to share the stage with former President George W. Bush in Washington, D.C., at the Ronald Reagan International Trade Center. He is honored to be recognized as a financial authority in the Chicagoland area. Anthony Pellegrino has passed the Series 65 securities exam and is registered as an Investment Adviser Representative. He also holds an Illinois insurance license.

In his spare time and work at Goldstone Financial Group, Anthony Pellegrino enjoys spending time in the Elmhurst community with his wife and three children. He has a passion for supporting the U.S. military and is an active advocate and sponsor of the USO and Operation Support Our Troops.

What made you decide to become a financial advisor?

I have always been interested in helping people achieve their financial goals. I started my career as an accountant and then transitioned into financial planning. I enjoyed working with clients one-on-one to help them create a plan that would work for them specifically. I liked the idea of being a fiduciary, which means that I am legally bound to act in my clients’ best interests.

What are some of the unique things that you offer at Goldstone Financial Group?

We pride ourselves on being a comprehensive financial planning firm. We not only provide asset management services, but we also offer retirement income planning, estate planning, and insurance services. We are a fee-only firm, which means that we do not receive commissions for selling products. This aligns our interests with our clients’ because we only make money if our clients are successful.

What is your philosophy when it comes to investing?

My philosophy is simple: I believe that everyone deserves access to quality financial planning and investment management. I work hard to provide my clients with the tools and resources they need to make informed decisions about their money. My goal is to help my clients build a solid foundation for their financial future and protect their hard-earned assets.

What are some of the biggest financial mistakes that you see people make?

One of the biggest financial mistakes that people make is not having a plan. People need to be proactive about their finances and have a plan in place in order to reach their financial goals. Without a plan, it is easy to make impulsive decisions with your money that can end up costing you in the long run.

Another big mistake is not diversifying your investments. Many people put all of their eggs in one basket, so to speak, and invest all of their money in one stock or one type of investment. This can be very risky, as if that one investment goes sour, you could lose everything. It’s important to diversify your investments and spread your risk around so that you are protected if one particular investment does not do well.

What is your advice for someone who is just starting out in their career?

My advice for someone who is just starting out in their career would be to start saving early and often. It may seem like a difficult task to set aside money when you are just beginning your career, but it is important to start building good habits early on. Even if you can only save a small amount each month, it will add up over time and put you in a much better position down the road. Another piece of advice would be to invest in yourself by pursuing higher education or professional development opportunities. This will not only make you more marketable and earn you a higher salary, but it will also help you keep up with the changing landscape of your industry.

What is your advice for someone who is nearing retirement?

There are a few key things that I always recommend for those who are nearing retirement. First, it’s important to have a clear understanding of what your retirement income will need to cover. This includes not just basics like housing and food, but also things like travel, healthcare, and leisure activities. Once you have a good sense of your expenses, you can start to think about how much income you’ll need to generate in retirement.

Next, it’s crucial to have a diversified portfolio that can weather market volatility. This means investing in a mix of stocks, bonds, and other assets that can help offset losses in one area with gains in another. And finally, I always recommend working with a financial professional who can help you navigate the complexities of retirement planning. A good advisor will have your best interests at heart and be able to offer tailored advice based on your unique situation.

What are some of the biggest concerns that you hear from clients?

There are a few concerns that come up frequently from clients. The first is running out of money during retirement. People are living longer and they want to make sure their nest egg will last. The second concern is market volatility. We have seen some big swings in the markets over the past 10 years, and people are worried about losing money if there’s another downturn. And finally, people are worried about rising healthcare costs. Healthcare is a big expense in retirement, and it’s only getting more expensive as we age.

What is your favorite part about your job?

There are two aspects of my job that I really enjoy. First, I love working with my clients and helping them achieve their financial goals. It’s very gratifying to see the difference that our work makes in their lives. Second, I enjoy the challenge of constantly trying to stay ahead of the market and find new ways to help my clients make money.

What are some of your hobbies and interests outside of work?

I enjoy spending time in the Elmhurst community with my wife and three children. I have a passion for supporting the U.S. military and am an active advocate and sponsor of the USO and Operation Support Our Troops.

Do you have any final words of wisdom for our readers?

No matter where you are in your financial journey, it’s never too late to start planning for your future. I always tell my clients that the best time to start saving for retirement is yesterday. If you haven’t started yet, don’t wait any longer. The sooner you start, the better off you’ll be. It’s also important to remember that retirement planning is a marathon, not a sprint. There will be ups and downs along the way, but as long as you stay the course, you can reach your goals. And finally, don’t go it alone. Work with a financial advisor who can help you create a plan tailored to your unique needs and goals. A good financial advisor will be there to help you every step of the way and make sure that you are on track to reach your targets.

Interviews and PR by Matt Peters and Team.

https://searchmanipulator.com